Partner

URBAN UP | UNIPOL

Urban Up is a real estate project developed by the Unipol Group that is dedicated to enhancing the value of some of the most important properties of the Group’s Italian architectural portfolio througn modernisation and renovation that combines innovation with respect for tradition.

The Urban Up project was launched in the city of Milan with the renovation of some of its most iconic buildings, and has been continued in several Italian cities with work done to both promote its trophy assets and regenerate suburban areas, deploying the value of sustainability in the area of real estate by adopting environmentally friendly solutions.

CONFINDUSTRIA ASSOIMMOBILIARE

Since its founding in 1997, Confindustria Assoimmobiliare has represented the real estate supply chain active in Italy. Its more than 200 members includes investors such as asset management companies, real estate funds, both listed and unlisted real estate companies, banks, and insurance companies. Additionally, it encompasses leading Italian and international developers, public entities managing significant real estate assets, real estate service providers, legal service firms, and real estate consultancies.

Read more

Confindustria Assoimmobiliare’s main objectives include supporting the growth of the real estate sector, acknowledging its significant role in Italy’s overall economic development, fostering a conducive investment environment for its members, and drawing national and international capital for territorial development and urban regeneration. The organization also focuses on representing and safeguarding the industry’s interests with institutional stakeholders, championing the principles of sustainable and responsible real estate investment (SRPI) and Environmental, Social, and Governance (ESG) tenets. It is also dedicated to aiding the green and digital transition of public and private real estate holdings, promoting market transparency, enhancing the reputation of real estate operators, and ensuring the provision of training for professional resources.

The association’s content development mainly takes place within the Technical Committees and Permanent Working Tables. Headed and organized by its members, these Committees and Tables delve into market analyses, insights into international best practices, position papers on relevant policies, and regulatory proposals to bolster both the real estate sector and Italy’s overall competitiveness.

Contacts

Via Quattro Novembre 114 – 00187 Roma

Via San Maurilio 25 – 20123 Milano

Tel. +39 06 3212271

E-mail assoimmobiliare@assoimmobiliare.it

Website www.assoimmobiliare.it

LinkedIn www.linkedin.com/company/associazione-assoimmobiliare

INVESTIRE SGR

Investire SGR is an leading independent fund, asset and investment management company, reference point for the Italian real estate sector.

With approx. 7 billion euro AuM through more than 60 real estate funds and SPV across all different asset class managing more than 2.000 single asset, Investire SGR is the partner of choice for more than 200 institutional national and international investors.

Read more

Considering the expertise and solid track record developed over more than 20 years of market presence, Investire SGR is active in all the different asset class ranging from yielding trophy assets to redevelopment and vale-add projects. The actual portfolio AuM breakdown is mainly composed by 48% of office assets, 34% residential (BtS, PRS, Student Housing and Social/Affordable Housing) and, for the remaining portion focused among special assets class as retail, healthcare, leisure and distressed asset, with a risk/return profile differentiated along all the different managed asset (core/core+, value added, opportunistic).

Main clients include pension funds, insurance companies, banks and other institutional national and international investors (i.e. private equity real estate), as well as family offices, UHNWI, HNWI and professional clients.

Investire SGR is part of Banca Finnat Group with 59% ownership and can leverage over a solid shareholding structure providing a strong financial stability and a flexible corporate governance.

Investire SGR is a pioneer in the Italian market regarding sustainability (both environmental and social) and one of the first player that starts to adopt ESG policies in its investment criteria and corporate governance. Moreover, since 2021, Investire SGR adopts, both on a corporate and funds level, the GRESB rating (Global Real Estate Sustainability Benchmark).

Contacts

Investire SGR S.p.A.

Via Po 16/A 00198 Roma | T. (+39) 06 696291 | F. (+39) 06 69629212

Largo Guido Donegani 2 20121 Milano

www.investiresgr.it

IPI Spa

IPI Spa is a Real Estate Management & Property Company: a real estate services company with its own real estate assets, specialised in real estate services and consultancy for investors, institutional operators, companies and private Clients.

IPI is also a co-investor in operations for the transformation and development of areas and buildings, showcasing its expertise.

The IPI Group covers the entire Real Estate industry, ranging from Integrated Technical Services to Valuations, Project and Construction Management, Brokerage Services, Representation of Owners and Tenants, Investment Consultancies, Management of underlying NPL and UTP Assets.

Read more

The activities concern both individual properties and entire assets for Residential, Commercial, Office, Industrial and Logistics use.

IPI’s real estate assets are diversified by use and location, and consist of major income property, areas and complexes in enhancement and development and trading properties, including the Polo Uffici and two accommodation facilities at Lingotto and Palazzo Ex RAI in Turin, that is currently being remediated.

The following brands are part of the IPI Group: IPI Management Services, with its subsidiaries IPI Engineering and IPI Condominium, is one of the leading independent real estate service companies in Italy.

IPI Agency is the agency and brokerage company of the Group, with branches in Turin, Milan, Genoa, Bologna, Padua, Rome, Naples and Bari. The Florence branch is due to open shortly.

NEXTTO Polo Uffici Lingotto and Lingotto 2000 manage the spaces for Office use and the parking spaces of the historic building in Turin.

RINA Prime Value Services

Building upon strong business ethics and a vision of sustainable growth, RINA Prime Value Services works alongside its clients to support the transition to a more forward-thinking, sustainable future. Sustainability and digitalisation are the pillars guiding our Group’s activities.

RINA Prime Value Services stands out for its expertise and ability to overcome the challenges of the real estate market, providing custom-made solutions that can be adapted to each client’s unique needs.

Through a truly global presence and an extensive partner network, RINA Prime Value Services supports its clients in meeting the challenges and opportunities which the future holds.

Read more

RINA Prime Value Services, the legal entity of RINA in Real Estate Services, comprehensively manages the entire real estate value chain. Our relentless pursuit of technological innovation, extensive and unique information assets, and unwavering commitment to sustainability enable us to provide our clients with customized solutions for every type of requirement.

Contacts:

RINA Prime Value Services

Via Lentasio 7, Milano

Via Corsica 82r, Genova

Via della Conciliazione 1-3, Roma

Tel. +39 02 45374010

www.rinaprime.com

info@rinaprime.com

SVICOM

Since 1996, Svicom SpA Benefit Society has offered comprehensive and integrated consulting services in real estate management and development.

Among the leading companies in the Real Estate sector at the national level, Svicom is an independent and Italian company, led by Fabio Porreca (Chairman and Major Shareholder), Letizia Cantini (CEO, General Manager and Partner) and Corrado Di Paolo (General Manager of Svicom Agency).

Read more

Svicom stands out as an all assets – full service provider, capable of combining pragmatism, innovation and highly qualified skills, distinctive elements of its DNA and competitive advantage.

Svicom S.p.A. Benefit Company is the parent company and controls Svicom Agency, Svicom Condominium Management, Svicom Global Service and Places Media.

Contacts

Real Estate Advisor in the Living Asset Class with a Strategic Approach and Cross-Functional Expertise

Since 1997, Abitare Co. has specialized in the marketing of newly built residential properties.

Operating nationwide, the company offers a comprehensive model that manages all phases of the real estate development process, positioning itself as a single point of contact able to deliver strategic advice, efficiency, and speed.

Its activities are built around an integrated service platform for the living sector, including: Advisory and Valuation, technical and design support, Marketing, and Agency services.

The team is made up of over 90 professionals with specialized expertise and solid experience, capable of responding to emerging market needs with a cross-functional and innovative approach. The business model focuses on service innovation and the use of advanced technologies.

Read more

Thanks to the Abitare Co. Research Department, the company analyzes real estate and economic trends and dynamics. This enables it to determine pricing strategies, reduce time-to-market, anticipate market changes, and deliver solutions aligned with evolving demand.

Abitare Co. plays a leading role in shaping the evolution of the residential product in Italy, with the aim of addressing the way people experience and live in their homes.

Contacts

For Press:

MY PR – Press Office Abitare Co.

Roberto Grattagliano – Tel. +39 02 54123452 – Mob. +39 338 9291793 – roberto.grattagliano@mypr.it

For any Other:

Abitare Co | Tel. +39 02 48958416 – +39 02 48958682

Via Savona, 52 20144 Milan (MI)

info@abitareco.it | www.abitareco.it

COMPAGNIA IMMOBILIARE ITALIANA

“The world is constantly changing: our job is to keep up with the world and to be one step ahead of competitors. That’s why we have developed a commercial gesture highly technological and at the same time emotional, which allowed us to guide users’ choices by perceiving their desires in advance”.

Angelo Musco, CEO

Compagnia Immobiliare Italiana is a joint-stock Company specializing in the sale of newly built residential properties.

Read more

The Company was born as a response to the need to maximize the sales of each property, through strategies and methods based on a scientific approach.

Real estate is based on relationships. In today’s digital world these relationships are built through immersive technologies and enriched with virtual experiences. With the current levels of competition, maintaining the classic sales approach is no longer enough. Compagnia Immobiliare Italiana knows how to emerge by finding alternative methods to reach and understand the audience through the advanced use of new digital technologies that collect data and monitor customer behaviour.

On the one hand, a specialized management with over 20 years of experience in real estate makes it possible to achieve strategic solutions that are always up to date. On the other hand, the continuous investment in new staff, in order to train excellent human resources for tomorrow, shows the Company’s forward-looking and proactive vision. The result is a competent and constantly updated Sales Team, which thanks to neuromarketing and technology, is able to speed up the sales.

Contacts

MILANO

Via G. Serbelloni 7, 20123

Tel. +39 02 43.99.86.88

ROMA

P.za del Popolo 18, 00187

Tel. +39 06 79.25.01.69

Sito web: www.compagniaimmobiliareitaliana.it

Email: info@compagniaimmobiliareitaliana.it

FS SISTEMI URBANI

FS Sistemi Urbani is the leading company of the Urban Business Unit of the FS Italiane Group.

Subjects of the company’s expertise are urban regeneration, intermodality, and first- and last-mile logistics. FS Sistemi Urbani aims to enhance areas that are no longer functional for railway activities and restore them to citizens, who will thus benefit from new services and gathering places without consuming additional land.

Read more

Fundamental pillars on which the company’s activities are based are environmental, social and economic sustainability, urban mobility, stakeholder engagement and the creation of public and private spaces to improve the well-being of citizens.

ONOFFICE

onOffice is the software solution created with and for real estate agents.

An all-in-one CRM and management tool, onOffice speeds up and streamlines daily work through automation and integrated artificial intelligence.

With over 20 years of industry experience, onOffice operates in 8 European countries and offers real estate agents a full range of services to grow their business — from the creation of professional websites to tailor-made web marketing packages.

Read more

Contacts

onOffice Italia SRL

Via Vincenzo Vela, 29, 10128 Torino TO

Tel. +39 (0)11 9270400

E-Mail: contatti@onoffice.com

Web: it.onoffice.com

PROGEDIL

Gruppo Immobiliare Progedil, partner of Colliers Italia, is a dynamic Agency reality that has been operating in the real estate market for over 30 years.

Active in Rome and the Lazio region, it is specialised in marketing, professional consulting and real estate brokerage for companies and private clients, including in luxury real estate.

Read more

The well-established partnership between Progedil Group and Colliers Italia’s Living Advisory team offers a strong commercial network and a new range of services for the Capital’s residential market, such as product development, fractional sales and after-sales. Active with several projects in Rome and the Lazio region, the basis of the partnership between the two groups also includes the redevelopment and promotion of pre-existing housing stock.

Contacts

Massimo Torri

Marketing Manager – Progedil Gruppo Immobiliare

massimotorri@progedil.it

Mob. +39 335 69 46 008

RE4COM | Real Estate for Company

RE4Com is a division, specialized in “Corporate” services and managed by Grimaldi family.

RE4Com communicates and works with the main Italian real estate operators and offers different services addressed to “Corporate” customers:

- Brokerage and advisory for portfolios and real estate assets

- Marketing and consulting in real estate development operations regarding residential and commercial areas, hotel and tourism

- Consulting in luxury investment operations both in Italy and abroad

Read more

RE4Com provides consulting services to value real estate portfolios and assets, both during analysis and management, and during competitive sale. Our wide presence on the territory and our forty-years experience allow efficient and productive management of entire buildings or their portions, giving all the parts involved full assistance in the whole sale process.

RE4Com is a reliable partner for the real estate development in different segments and different phases: the identification of the area/property, through the production process or transformation up to the different stages of alienation.

Contacts

RE4COM | Real Estate for Company

P.le Arduino, 1 | 20149 Milan | Tel. +39 02 49597676

www.re4com.com | Company Profile

REYNAERS ALUMINIUM ITALY

As part of Reynaers Group, Reynaers Aluminium is a leading European specialist in the development and marketing of innovative, sustainable aluminium solutions for windows, doors, and façades. Together with our partners, we focus on design and creating solutions that increase the value of real estate assets, combining aesthetics, energy efficiency and durability.

Reynaers Aluminium is founded in 1965 and currently employs over 2,600 workers in more than 40 countries worldwide. The company exports to more than 70 countries on 5 different continents. In 2024, Reynaers Group achieved an annual turnover of 703 million euros. The company’s success is strengthened by our close partnership with 5,000 partner fabricators and facadeis, with services dedicated to architectural firms, general contractors and real estate developers. This unique cooperation is reflected in our motto: “Together for better”.

Read more

At Reynaers Campus, our headquarters in Belgium, we invest in training, research and the development of cutting-edge technologies. A space where architects, fabricators, contractors, investors and other building partners can experience the potential of our solutions first-hand, exploring the buildings of the future also thanks to Avalon, our immersive virtual reality room.

In a real estate market where attention to environmental impact, construction quality and energy efficiency is increasingly central, Reynaers Aluminium provides high-performance and innovative systems, ideal for those who want to differentiate their offer by creating sustainable and valuable projects.

“Together we are improving the living and working environment for people now and for future generations.”

Contacts

Via Leonardo Da Vinci 2 – 25010 San Zeno Naviglio (BS)

Tel. +39 030 210 6790

E-mail: info.italia@reynaers.com

Website: https://www.reynaers.it/

Linkedin: www.linkedin.com/company/reynaersaluminiumitalia

Instagram: www.instagram.com/reynaers.aluminium.italia

SOCIETE GENERALE Securities Services in Italia

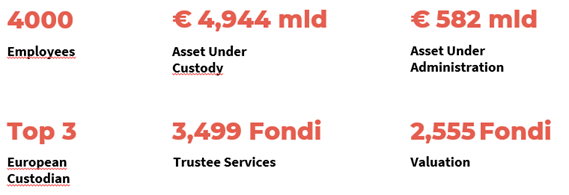

Recognized for the quality of services, the agility of solutions and the extension of the international network, SGSS, as a global custodian, supports clients in their challenges in terms of resources, regulations, risks, operations or asset diversification by offering specific solutions in line with the latest market evolutions.

Read more

STANTEC

Stantec is a global leader in sustainable engineering, architecture, and environmental consulting.

The diverse perspectives of our partners and interested parties drive us to think beyond what’s previously been done on critical issues like climate change, digital transformation, and future-proofing our cities and infrastructure.

In addition to assisting the real estate industry and investors in design and planning, the multidisciplinary nature of our teams allows us to offer comprehensive consulting services, covering all aspects related to project development.

Read more

From environmental, technical, and economic consulting to architecture and engineering design, we offer support in real estate transactions involving greenfield and brownfield development.

Contacts

Matteo Bellinello

International Business Development Director

Tel. +39 02 94759985 – Mob. +39 347 3826314

matteo.bellinello@stantec.com

TECNOMONT SERVICE

Tecnomont Service is a company specialising in building envelopes and the renovation of civil and industrial buildings.

The company engineers, designs, manufactures and installs curtain walls, windows and aluminium components.

As a general contractor, Tecnomont Service manages and supervises all activities for the redevelopment of buildings, guaranteeing a turnkey delivery to its clients and ensuring a complete and detailed service.

This experience, combined with the skills of its technical operating staff, allowed to create a department exclusively dedicated to maintenance and fire prevention work. In Milan alone, Tecnomont Service deals with both fixed and on-call maintenance of over 200 buildings belonging to real estate funds, SGRs, insurance institutions, public buildings and hospitals, taking care of their efficiency for the maintenance of real estate assets.

Read more

The company’s historical headquarters is in Pozzo D’Adda- Milan, with a technical office in Genoa, working on the design and development of technical and innovative solutions for the architectural envelope.

AMONG OUR PROJECTS

Tecnomont Service collaborates with prestigious engineering and architecture firms of national and international renown.

Among the projects, recently completed or under construction, are the new University Campus of Architecture of the Milan Polytechnic, based on a concept by arch. Renzo Piano and project by Studio ODB-Ottavio Di Blasi & Partner; the redevelopment of Torre Velasca in Milan, project by Asti Architetti; the Porsche Experience Center in Castrezzato (BS), project by GBPA Architetti; the redevelopment of the former Traversi garage in Milan.

Further information available at www.tecnomontservice.com.

Contacts

Tecnomont Service srl | Via Meucci 3, Pozzo D’Adda, Milano | Viale B. Bisagno 2, Genova | Corso Venezia 5, Milano

Tel. +39 (0)2 84990103 | info@tecnomontservice.com | www.tecnomontservice.com

YARD REAAS Spa

YARD REAAS is an independent group, leader in Italy in real estate consulting and integrated management of real estate services. It operates both in the institutional market and in the distressed segment for Italian and foreign investors, banks, AMCs/funds, industrial groups, private equity funds and family offices.

YARD REAAS boasts over 30 years of experience in Technical (Due Diligence, Project Management & Monitoring, Engineering), Environmental, ESG, Valuation and Property & Building Management sectors.

In the ESG (Environmental, Social, Governance) field and investment sustainability criteria, in 2015 it was the first real estate consulting company in Italy registered with PRI – Principles for Responsible Investment.

Read more

The Group, in synergy with the subsidiaries AEGIS, YARD Credit & Asset Management and YARD RE, is present in Italy, with its offices in Milan (the headquarters), Rome, Brescia, Vigevano and Trento as well as abroad in the UK and France, with its London and Paris offices.

Contacts

YARD REAAS SpA

Milan, C.so Vittorio Emanuele II, 22 – 20122

Tel. +39 02 7780701

info@yardreaas.it

www.yardreaas.it